|

It occurred to me recently that I’ll never REALLY be satisfied with paying for insurance. Home. Auto. Life. Travel....whatever. I could think of hundreds of things I'd rather spend $3,000 a year on. 1. Buy used Seadoos every year to ride and abandon. 2. Buy new grass each year and never take care of it knowing more is coming next year. 3. Unlimited Ice Cream and Milkshake Budget. 4. Donate it. (had to offer up SOMETHING that wasn't totally self indulgent) This could go on, but I think you see where I'm going here. Insurance is a lot like PROPERTY TAX or AN OIL BILL. I don't WANT to pay it, but it's a requirement if you have a vehicle, or home. So with this in mind, I submit to you a suggestion for improving your feelings about these payments. GET VALUE.Make sure the money you spend is MAXIMIZING your personal enjoyment of this otherwise disappointing expense.It seems that a LOT of people derive the VALUE from knowing they paid the absolute bottom dollar for insurance coverage. They shop for new carriers every year, they don’t mind waiting on hold forever, and they have zero interest in getting to know the people offering that product. THE VALUE FOR THEM is about feeling like they got the VERY LOWEST PRICE AVAILABLE. In today's world.... I TOTALLY get that approach. It keeps the most dollars in your pocket TODAY, and you're rolling the dice on never needing to use it. If you're this type of customer....consider a direct insurer. There are lots of them out there catering exactly to what you're looking for. (TD, UNIFUND aka JOHNSON, Sonnet, etc) The model is setup so that the insurers save costs on selling it (using call centers) and then pass some of those savings to the customer through lower premiums. ALL UPSIDE right? Not necessarily. There's usually a TRADE OFF.When you buy direct from an insurer, you're opting to represent yourself in all dealings with that provider. A broker's job is to advocate for their client in a claim. So by removing the broker from the equation you're forfeiting that extra layer of protection/advice you could be getting. No different than buying a home without a realtor. Super idea until you find out the house is built on a swamp. Since you're actually risking more to buy direct it makes sense the price should be lower. If you have a claim that goes sideways hopefully you've banked some of that money you've saved on premiums to hire a lawyer. You forfeit the right to complain if you declined a coverage to save money, or don't feel well represented in a claim situation. You shouldn't troll the TD social media accounts about how BAD THEY ARE AFTER A CLAIM IS DENIED. *Although I should admit I enjoy reading those. If lowest price was the only thing people VALUED the market would be FLOODED with Kirkland Basketball Shoes and Big 8 Jeans...yet I can't find Big 8 Jeans anywhere. VALUE can be lots of things... |

|

Insurance companies choose pricing on policies to bring them customers they WANT to insure.

Paying your bill, and being financially reasonable is a big step towards keeping you on the WANTED list. Pricing can be complicated and insurers tweak their offerings all the time to attract MORE of the risks they want, and LESS of the risks they don't want. STAY ON THE WANTED LIST! |

Once renewal rolls around though, that's when you'll see the additional costs.

This leads to shopping for coverage elsewhere right away, and your options are often less attractive.

PAYMENT IN FULL?!

If you decide to go elsewhere "since this is ridiculous" you're likely to have an even higher premium elsewhere since you've been removed from the WANTED list.

Tons of people end up getting cancelled for non-payment simply because they didn't know it they had to cancel it.

Some people will put a 'stop pay' on their payments rather JUST CALLING them to cancel it.

You accidentally push your future self off an insurance rating cliff.

If you’re living paycheck to paycheck and you sometimes have to ask: "WHICH BILL IS GETTING PAID THIS MONTH?"

You can save FUTURE YOU some money by putting your insurance bill near the top of the pile.

- MD

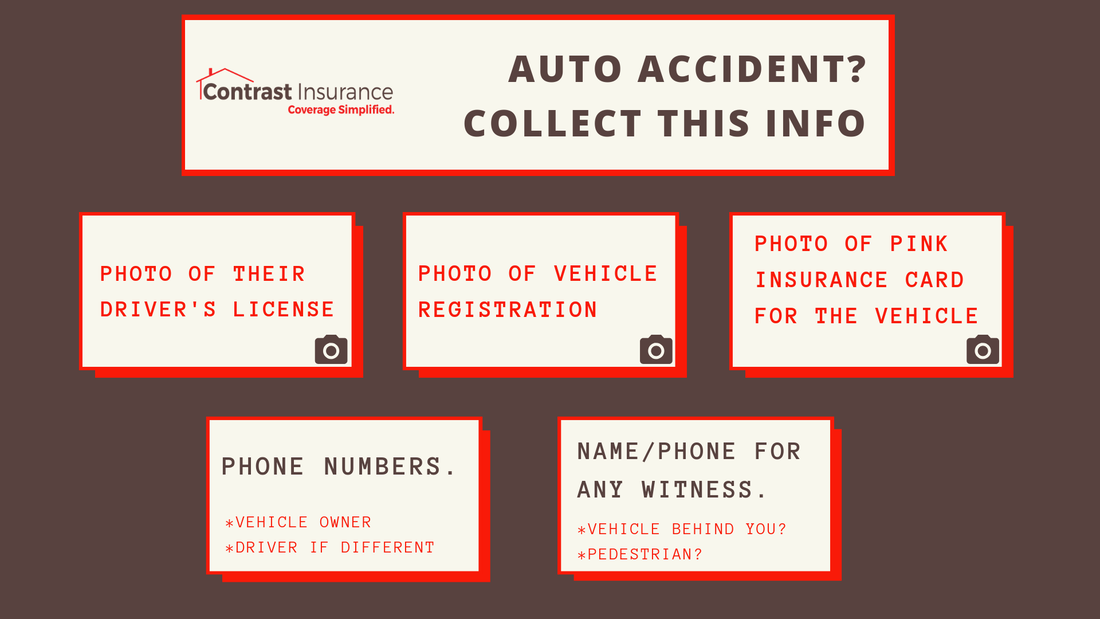

Think of it as a HOW TO on navigating the aftermath of an auto collision and what info is important to collect.

1. IF POSSIBLE....PULL OVER.

2. KEEP IT TOGETHER.

Both of you are inconvenienced and you're now in it together...so don't play the blame game. Just get what the info you need and get out of there.

3. USE YOUR PHONE.

4. CAN YOU GET A WITNESS?

Driver 2 is navigating the parking lot in search of a parking spot so they can go inside and buy a truckload of Chicago Mix Popcorn because it's delicious.

Driver 1 is done sending their texts and is ready to finally leave. They cut the wheel and back out of their spot and bump right into the front of Driver 2's vehicle.

Damage Overview: Driver 1's back bumper and Driver 2's front bumper.

Driver 2's LOSES THEIR MIND on Driver 1 because they've not read this blog post about 'KEEPING IT TOGETHER' and the inevitable delay on the Chicago Mix is setting in.

Driver 1 has gone from feeling bad, to wanting to do it again. After they exchange information and leave, they decide their recollection of the events was that they pulled out, and started driving away when Driver 2 RAN INTO HIM.

FIND A WITNESS IF YOU'RE IN AN ACCIDENT.

OFFER TO BE A WITNESS IF YOU SEE AN ACCIDENT.

Grab their info, and go get that Chicago Mix so the trip wasn't a total waste.

MD

About the author

Matt Davison is a |

Categories

All

Auto Accidents

AUTO INSURANCE

Auto Insurance Rates Explained

Back To School

Brokers

Cancellation

Claims

Deductibles

Flood Coverage

Home And Auto Insurance Advice

Home Insurance

IBAC

IBANS

Ice Damming

Landlord

Non Payment

PROPERTY INSURANCE

Rental Property

Replacement Value

TELEMATICS

Tenant Insurance

The Role Of A Broker

Archives

January 2024

May 2023

February 2023

March 2021

February 2021

June 2020

October 2019

September 2019

June 2019

March 2019

February 2019

January 2019

October 2018

August 2018

June 2018

May 2018

RSS Feed

RSS Feed