|

| Everyone loves 'fast and easy' when buying things. The downside is that it doesn't always translate to 'Great Service'. GET YOURSELF A ‘GO-TO' PERSON. Ideally it's the same person each time because explaining myself multiple times to new people is a special kind of awful for me. I find real value in ‘knowing someone to call' when I have a problem...and with all else being equal I'll take service and relationship every time. | "Why yes. I'd love to hold. thanks." |

CLAIMS GUIDANCE.

A good broker should be able to work with you throughout a claim.

They can:

- Help with documentation and getting things started right.

- Retrieve answers when things aren’t moving quickly.

- Set expectations and explain things as they are happening.

- Keep an eye out for what's best for YOU on renewal and going forward.

'Lawyering up' right away on a denied claim and dealing with it all yourself can take years off your life mentally not to mention draining you financially.

Last but not least.

SUPPORT SMALL BUSINESS.

Supporting small businesses feels good and creates local jobs.

Multinational Conglomerates are great... but if you can support someone in the community that'd be my preference.

-MD

EXCITING NEWS FOR CONTRAST INSURANCE

Thanks for reading.

-Matt D

Property Claims are on the rise.

Learn what to do when they happen.

Some Advice from a former Claims Adjuster.

Probably try to stop the problem right? Yes. Try to stop things from getting worse.

Turn off the water if it's a broken pipe spraying in your living room.

Cover the pot that just burst into flames. (The number of people who make fries on their stove is ASTONISHING to me.) Lift things off the floor that water is moving towards. Use towels/shop vacs...do something to try and stop damages from happening.

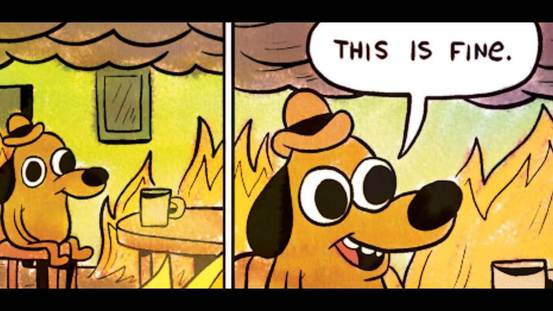

These sound obvious, but when people are in a panicked situation sometimes common sense goes out the window.

These layout requirements for an INSURED (that's you) to at least try and 'mitigate a loss'. That's a fancy way of saying, preventing more damage from happening if you can.

"WOW. Good thing I bought insurance! I'll be at my mom's if you need me."

EXAMPLE: A flooded (finished) basement.

- It will take a week or more to get it dried out.

- Then a week or more to agree on the scope of the damages.

- Then who knows how long to collect repair estimates and decide on a contractor.

- Then the repairs to be completed.

- Replacing, or settling the damaged contents.

On average a couple months.

AT WORST, well let's just hope it's not the worst.

- MD

About the author

Matt Davison is a |

Categories

All

Auto Accidents

AUTO INSURANCE

Auto Insurance Rates Explained

Back To School

Brokers

Cancellation

Claims

Deductibles

Flood Coverage

Home And Auto Insurance Advice

Home Insurance

IBAC

IBANS

Ice Damming

Landlord

Non Payment

PROPERTY INSURANCE

Rental Property

Replacement Value

TELEMATICS

Tenant Insurance

The Role Of A Broker

Archives

January 2024

May 2023

February 2023

March 2021

February 2021

June 2020

October 2019

September 2019

June 2019

March 2019

February 2019

January 2019

October 2018

August 2018

June 2018

May 2018

RSS Feed

RSS Feed