Big day tomorrow as Canada formally legalizes Cannabis!

While you're out celebrating the big change, or hiding from second hand smoke...I'm over here considering the impact on insurance coverage.

*Insurance Nerd Status CONFIRMED if it was ever in question.

Let's bring everyone up to speed on the how this is going to work.

On Wednesday Oct 17th 2018

Canadians over the age of 19 will be allowed to:

*You can possess up to 30 grams, and grow up to 4 plants per household.

Local Municipalities like the City of Halifax, or the Town of (insert any town) get the honor of creating and enforcing bylaws to dictate WHERE you can use it or grow it.

*Shout out to Halifax on their VERY popular choices so far on the new bylaws.

Indoor grow ops and smoke filled bus stops are the future.

Now that people can legally possess this stuff, insurance companies need to revisit how they plan to handle claims related to it.

Here's 4 insurance changes to consider about Cannabis

1. Weed just became INSURED CONTENT.

Prior to legalization Mary Jane was always excluded from Property Insurance coverage.

The specific exclusion is often worded something like: “ILLEGALLY ACQUIRED, KEPT, OR STORED CONTENT”.

Since tomorrow is the big day and it's NOT illegal anymore, insurer's have to switch things up.

Most property policies will see Cannabis moved to the SPECIAL LIMITS section to put a maximum payout on Cannabis at say $500 or $1000.

There is at least ONE insurer who is not limiting Cannabis at all for MEDICINAL users.

Everyone's situation is different, but if you're sitting on a year's supply of the stuff you may want to make sure you're not limited to $250 in coverage.

2. Most insurers will be EXCLUDING CANNABIS from Trees, Shrubs, and Plants related coverage.

This isn't exactly a change, but it's worth noting that if you are spending some time and effort growing outdoor plants, it's unlikely that any insurer is extending coverage to those plants.

Worried about Bambi and his crew with the munchies eating your plants?

Maybe put up a fence.

3. Impaired Driving w/Cannabis will be A LOT like Drinking and Driving.

Insurers are rolling these convictions into the same pile as drinking and driving.

If you think Auto Insurance is expensive NOW you won't want to see how one of these on your record jacks up your rate.

In addition to the fine and probable license suspension...whoever is unlucky enough to get the first of these tickets is probably going to make the news.

The money being spent on "don't drive high" ad campaigns is serious, and I think we can all expect a real focus on it from Police.

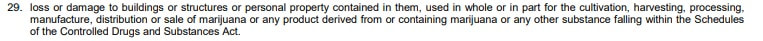

4. Building/Content damages CAUSED by GROWING.

This one is interesting.

A COMMON EXCLUSION in most homeowner policies talks about damages caused from using the home to grow marijuana. It often looks something like this:

The old exclusion talks about marijuana directly, and also points to the CONTROLLED DRUGS and SUBSTANCES ACT which USED to have Cannabis listed.

But as of tomorrow, Cannabis will be OUT of the CONTROLLED DRUGS and SUBSTANCES ACT and getting into it's own CANNABIS ACT. Most insurers have made changes to the language in policy to better explain what they're trying to exclude.

Here's an example of a new one:

On all policies, excluding watercraft, loss or damage to buildings or structures or personal property contained in them is excluded when used in whole or in part for the cultivation, harvesting, processing, manufacture, distribution, or sale of cannabis or any product derived from or containing cannabis, except as allowed by law.

Changes like these lead me to believe that the trend will be for insurer's to be OKAY with the risk that people are growing 4 plants inside their home.

That being said, this is only one company. There are all kinds of property insurers out there including a number of direct markets who don't always follow industry standard.

It's very possible some companies will not have any changes ready for tomorrow or they may have no interest in covering loses due to growing plants indoors.

So if you're planning to grow a few plants indoors, you may want to check with your broker to make sure any damages caused by it would in fact have coverage.

Based on how I'm reading some of these these wordings, opting to grow a few more than what's ALLOWED BY LAW could be enough to deny a claim in some situations.

I have NO DOUBT this will be a contentious issue for years to come for insurers and clients who push the envelope on growing one too many plants.

There is a real risk in growing plants indoors if you don't take the proper precautions. A lot of heat comes off these high-powered lights. There are often extension cords and exhaust fans, with containers of water sometimes in tight spaces.

Whether you use it medicinally, or just for recreation make sure you're covering your bases and being responsible. If you're going to take a crack at it, do your homework and treat the process with some respect.

2018 is quite a time to be alive.

-MD

0 Comments

Leave a Reply. |

Categories

All

Archives

January 2024

|

|

|

|

RSS Feed

RSS Feed